Creating Safety Plans For Home and Family

No one likes to think that a disaster can strike them. However, the reality is that times are uncertain, and disaster can strike a family with little notice. With the increase of superstorms, flooding, weather anomalies and other calamities on the rise, the risk of a person becoming incapacitated or having a home and belongings being damaged from disasters has risen significantly.

Securing Assets in the Event of Major Injury or Disasters

It is also important to keep a plan in place in the event of a major storm such as a tornado, wind storm, flooding or tropical storm in protecting the home, health, and assets. Finding the best way in advance of a potential storm to secure life, home and property is essential. Last minute preparations can cause unforeseeable problems that may result in losses.

When it comes to living trusts, they can be especially helpful for a person who gets injured and is incapacitated for a time. People should seek professional help in learning what is a living trust and how they should begin to set one up. Having assets in a living trust allows for a spouse or other trusted person to be able to access certain designated assets to pay bills and take care of things while the person is incapable of doing so.

Taking measures to secure personal assets against calamity can make a big difference in the outcome of any catastrophic event. Having proper life, medical and property insurance levels in place beforehand as well as having a living trust can be especially important protection in the event of an unforeseen disaster.

People who live in areas that are inclined to poor weather should be certain they have sufficient insurance on their health, life, belongings, and assets. This should be examined before a catastrophe strikes and any adjustments made in coverage amounts to ensure the best insurance policy is intact.

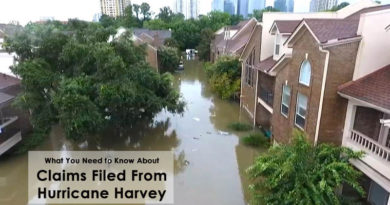

People who live in areas where flooding and superstorms are less common may be complacent. However, this is not a wise idea. In the last few years, there are many areas of the country that people felt were safe from catastrophic flooding and storms that have been struck. People with insufficient insurance end up having severe losses in such cases.

Creating a Safety Plan for Home and Family

When it comes to securing a home and family in the event of such events, one of the best ways to protect for such an event is to have plans for disasters in place in case one occurs. In America, emergency family disaster plans were much more commonplace after 9/11 and during times of war. That is because the level of uncertainty was greater. However, when these issues are not at the forefront of people’s minds, they often become more complacent.

But events such as 9/11 and life during wartime simply underscore the need for emergency plans to be in place for any type of calamity or disaster. One of the more common concerns today is the effects of storm systems which can wreak havoc on homes and other properties as well as cause human injuries and more.

Having a well thought out family plan for emergencies is vital. The plan should consist of having a preset of instructions for all family members to meet at a certain location if cell phone communications go down. With the latest series of mass flooding and superstorms, this backup plan is more important than ever.

Since most people today rely more on cell phones than land lines, there is an increased complacency about having emergency back up plans. Many people falsely believe they will be readily able to contact loved ones if there is an impending disaster by cell phone.

However, this could become easily problematic if cell towers go down from a storm or there are communication disruptions. Having an emergency plan in place before such events ensures everyone knows exactly what to do and where to meet if cell phones do not work.

The best plan of action is to always be prepared for potential weather calamities and the protection of their assets. In most cases, adding the proper insurance coverage for such events is easy and the cost is usually low. Sitting down and doing a review of insurance policies for home, auto, personal belongings, and life and getting the right coverage in place should be the main priority for anyone who owns assets.